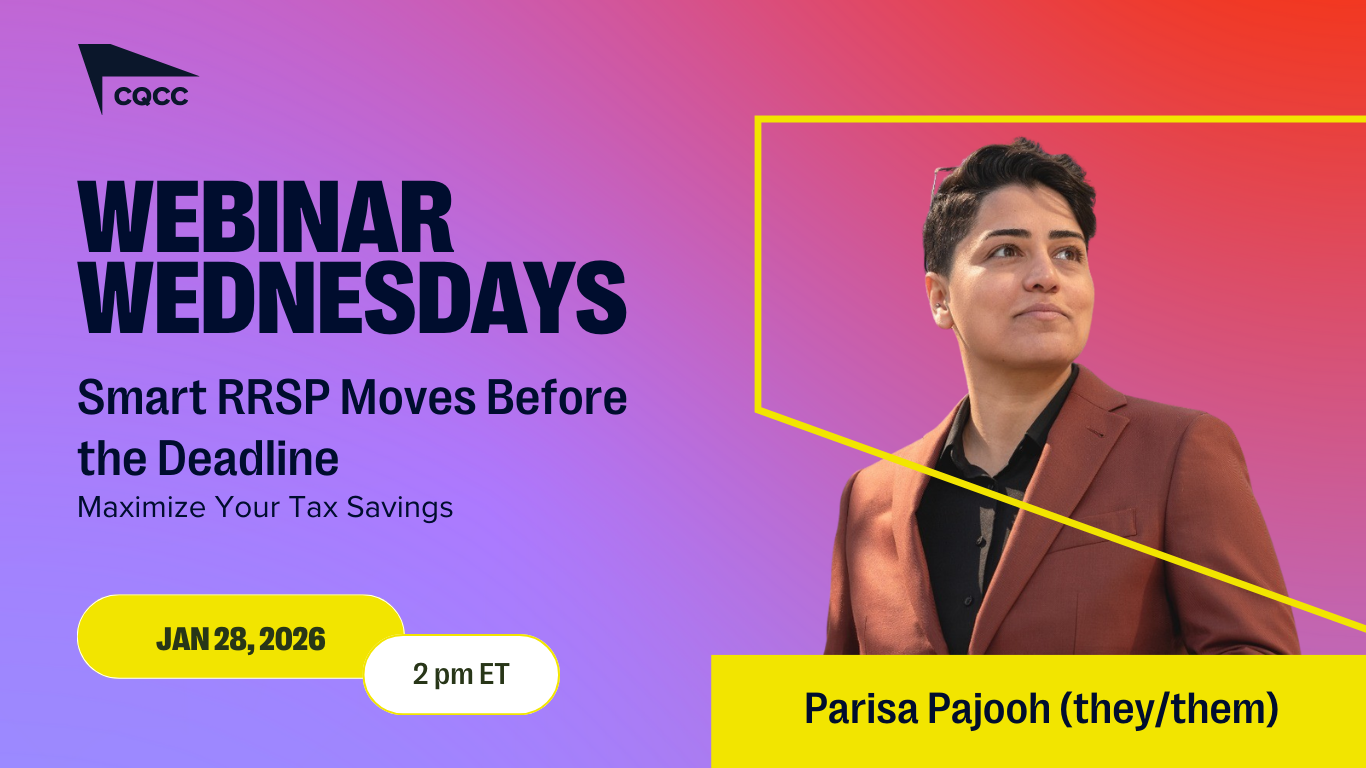

Webinar Wednesday: Smart RRSP Moves Before the Deadline: Maximize Your Tax Savings

January 28 @ 2:00 pm – 3:00 pm

The RRSP deadline is approaching — are you making the most of your opportunity to reduce taxes and grow your retirement savings?

In this practical session, we’ll break down how RRSPs work, who benefits most, and smart strategies you can still use before March 1st. Whether you’re new to investing or simply want to avoid costly mistakes, this webinar will give you clear guidance to stay on track with your long-term goals.

Key Takeaways

Attendees will learn:

Common mistakes to avoid before the deadline

What the RRSP deadline really means

When to choose RRSP vs. TFSA (and when to use both together)

How RRSP contributions reduce taxes and increase refunds

RRSP strategies specifically for self-employed individuals and business owners, including how to smooth income and reduce tax bills

Quick and effective late-season contribution options: cash, transfers, and RRSP loans

How RRSPs coordinate with employer pension plans

Our Team

Parisa is the founder of Diverse Wealth, a queer financial advisor and educator specializing in inclusive and accessible financial and investment planning.

As a CCQC-Certified Supplier, Parisa is committed to serving the queer community and allies with trust and personalized planning that supports each person’s unique financial journey.